August brought greater clarity on tariff levels for US imports, giving supply chain stakeholders a stronger basis to reassess the outlook for the remainder of the year.

This was a recurring theme in global carriers’ H1 2025 investor updates. For instance, Hapag-Lloyd sees the tariffs subduing the 2025 peak season

“the new tariff rates are lower than originally proposed; however, they are still expected to constrain short-term volume growth on US bound routes.”

China and India in Focus

Much industry commentary has centered on the tariff-driven booking collapse and rebound in the China–US trade, the US’s largest lane. However, other markets are showing similar patterns. According to recently published PIERS data and JOC analysis, India–US trade flows are also being significantly impacted by tariffs. With an effective tariff rate of 50% now in place:

“Laden imports from India jumped to 152,630 TEUs in July, an all-time record, as shippers rushed to beat the August tariff deadline… The US tariffs are significantly increasing landed costs of goods from India, exposing them to a pricing disadvantage of up to 35% compared to Asian competitors, one India-based shipper group estimates.”

WTG Data Insights

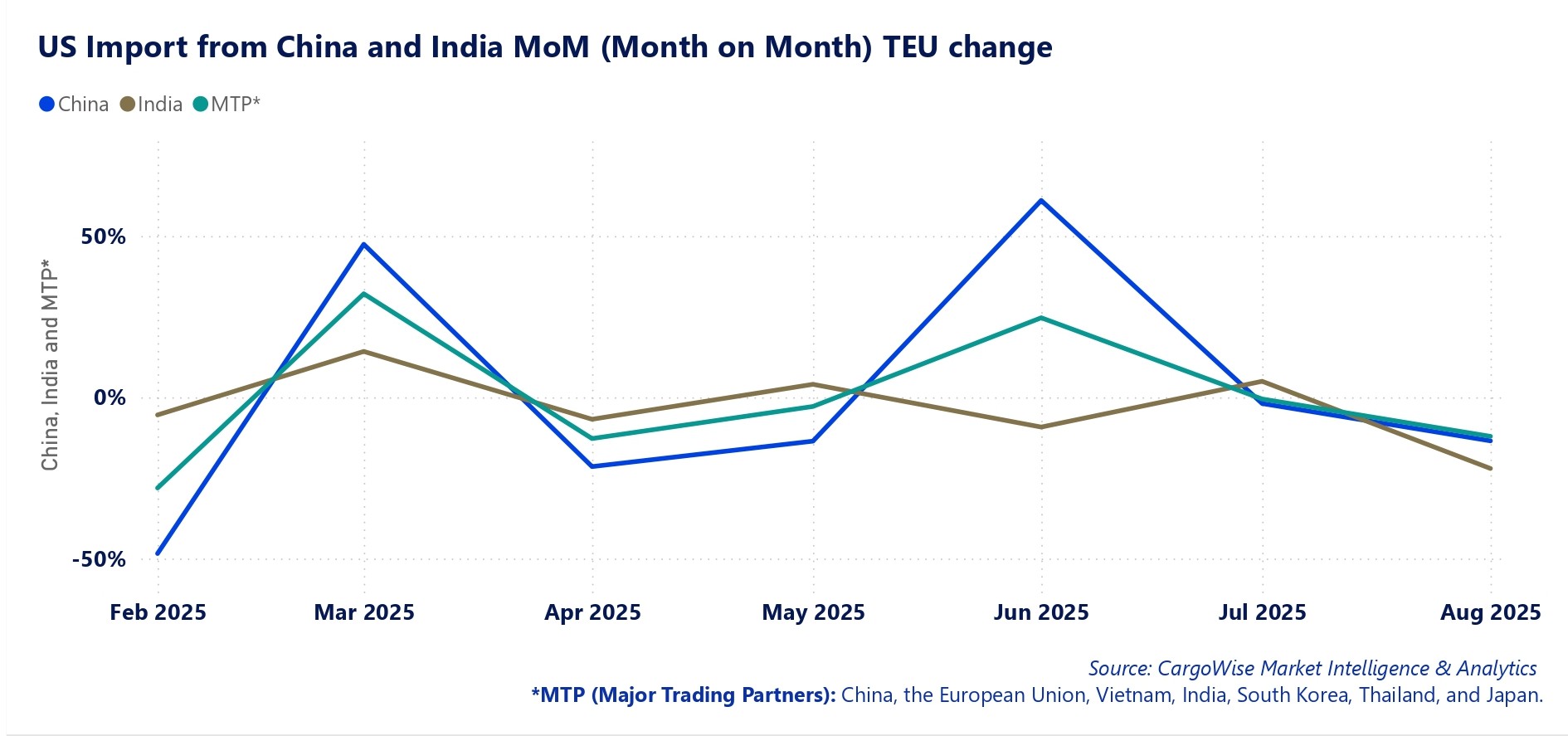

To broaden the perspective and look ahead to August, WiseTech Global data on container flows reveals the tariff impact across major US trading partners. We tracked market share, effective tariff rates, and month-on-month volume shifts.

| Trade Partner | Imports M TEU | Market Share | Tariff Level | Var AUG 24 |

|---|---|---|---|---|

| China | 11.8 | 42% | 30% | -28% |

| EU* | 3.2 | 11% | 15% | 20% |

| Vietnam | 3.0 | 11% | 20% | 15% |

| India | 1.2 | 4% | 50% | -23% |

| Korea | 1.2 | 4% | 15% | -5% |

| Thailand | 1.1 | 4% | 19% | 23% |

| Japan | 0.7 | 2% | 15% | 11% |

| Major Trading Partners | 22.2 | 78% | -12% | |

| US Total | 28.4 | 100% |

As the chart shows, August volumes declined sharply on the India–US trade, clearly correlating with tariff increments and subsequent shipment slowdowns.

Additional Market Pressures

Beyond tariffs, carriers are also navigating:

- Fleet growth: Ongoing new vessel deliveries adding capacity to global supply.

- Policy changes: Implementation of USTR measures and new port fees (from October), prompting vessel redeployments to mitigate cost impacts.

- Geopolitical risks: Continued rerouting of vessels around the Cape of Good Hope.

- Port congestion: Severe delays across major European and Asian gateways.

Diverging Carrier Outlooks

Carriers’ forward-looking statements underscore contrasting expectations:

From Hapag Lloyds more optimistic outlook

“Despite various disruptions in the past, global trade has proven to be resilient and is expected to continue growing”

To ONE’s more conservative view

“the current global environment remains highly uncertain, recent trade uncertainties further complicate visibility for the latter half of the fiscal year……the overall market environment may not prove as robust as initially anticipated”

Outlook for BCOs and Forwarders

While opinions diverge, one certainty remains: Beneficial Cargo Owners and Freight Forwarders must closely monitor markets and understand their carriers’ responses to changing dynamics in order to navigate increasingly volatile and uncertain conditions. Tariffs, cargo demand, capacity dynamics, and policy shifts will continue to drive both challenges and opportunities throughout the remainder of 2025.

Sources

- Publications - Hapag-Lloyd

- Journal of Commerce - Gateway

- NYK Line - Investor Relations

- NYK Line - Financial Results for Q1 FY2025

WiseTech Global’s Market Intelligence & Analytics platform tracks key trends and delivers insights into the numbers that shape the market, powered by a unique data-set unmatched in scope and size.

Further information:

- Download the CargoWise Market Intelligence & Analytics flyer

Want to take the next step?

WiseTech Academy is dedicated to democratizing logistics education, making it easier for everyone, regardless of experience, to succeed in the industry. Explore our full range of courses and find the right diploma or certification for you.