Despite a clear disconnect between freight rates and service quality, WiseTech data reveals widening differences in performance across carriers. The question is whether the market is finally ready to recognise reliability as something worth paying for.

The industry debate

A fresh debate has broken out over whether shippers should pay more for reliability.

Many argue that getting goods to their destination on time should be a basic expectation, not a premium service.

For others, particularly those investing heavily in their networks and technology, reliability is a differentiator that deserves recognition, and potentially a higher rate.

This tension sits at the centre of today’s liner shipping market: should reliability be treated as table stakes, or as a value-added service that reflects genuine investment and performance?

What the data shows

We set out to test and quantify something the industry already senses intuitively: that freight rates are driven by market conditions, not by service quality.

Using monthly WiseTech data for ten of the world’s largest carriers between October 2023 and October 2025, we built a Composite Service Quality Index (SQI) based on three operational measures that directly impact shippers:

1. On-time arrival – network service reliability

2. Booking request acceptance rate – how often booking requests are confirmed

3. Speed of response to booking requests – how quickly those confirmations or rejections are issued

Each metric was normalised and combined into a single index, where 1 represents consistently high performance and 0 represents weak reliability.

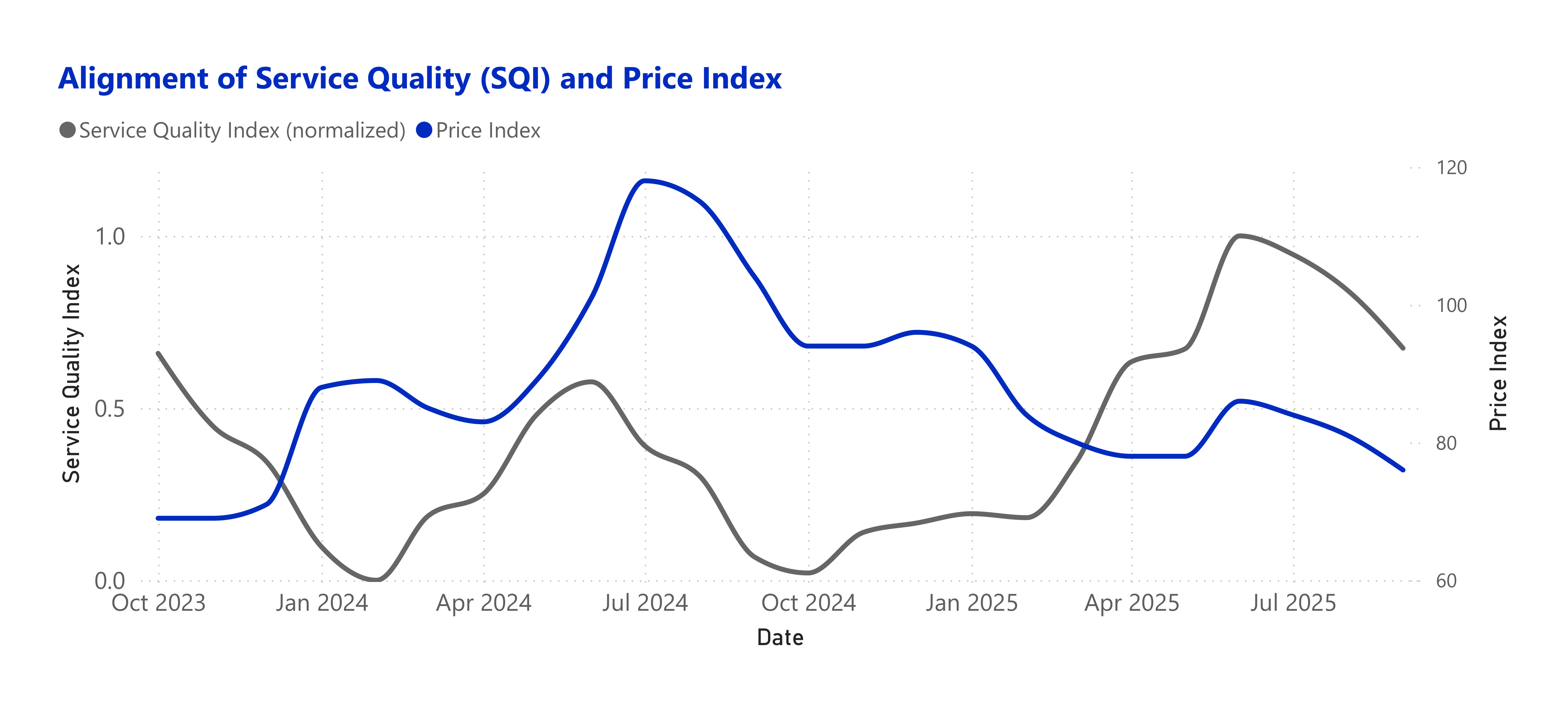

When we compared this index with an independent freight price index published by Container Trade Statistics (CTS) over the same period, the outcome was striking but unsurprising:

Freight rates and service quality moved in opposite directions.

- From late 2023 through mid-2024, freight prices climbed sharply while service quality deteriorated.

- From mid-2024 through mid-2025, reliability improved while prices declined.

The statistical correlation between the two was –0.48, confirming a clear disconnect.

This isn’t to suggest that poor service causes higher prices, rather, it highlights that pricing remains dominated by macro factors such as supply and demand, operational constraints, and geopolitics.

These variables drive rates up or down regardless of whether service reliability improves or erodes.

What the data makes visible is how weakly service quality is reflected in market pricing, even when the operational performance gap between carriers widens.

A market of unequal performers

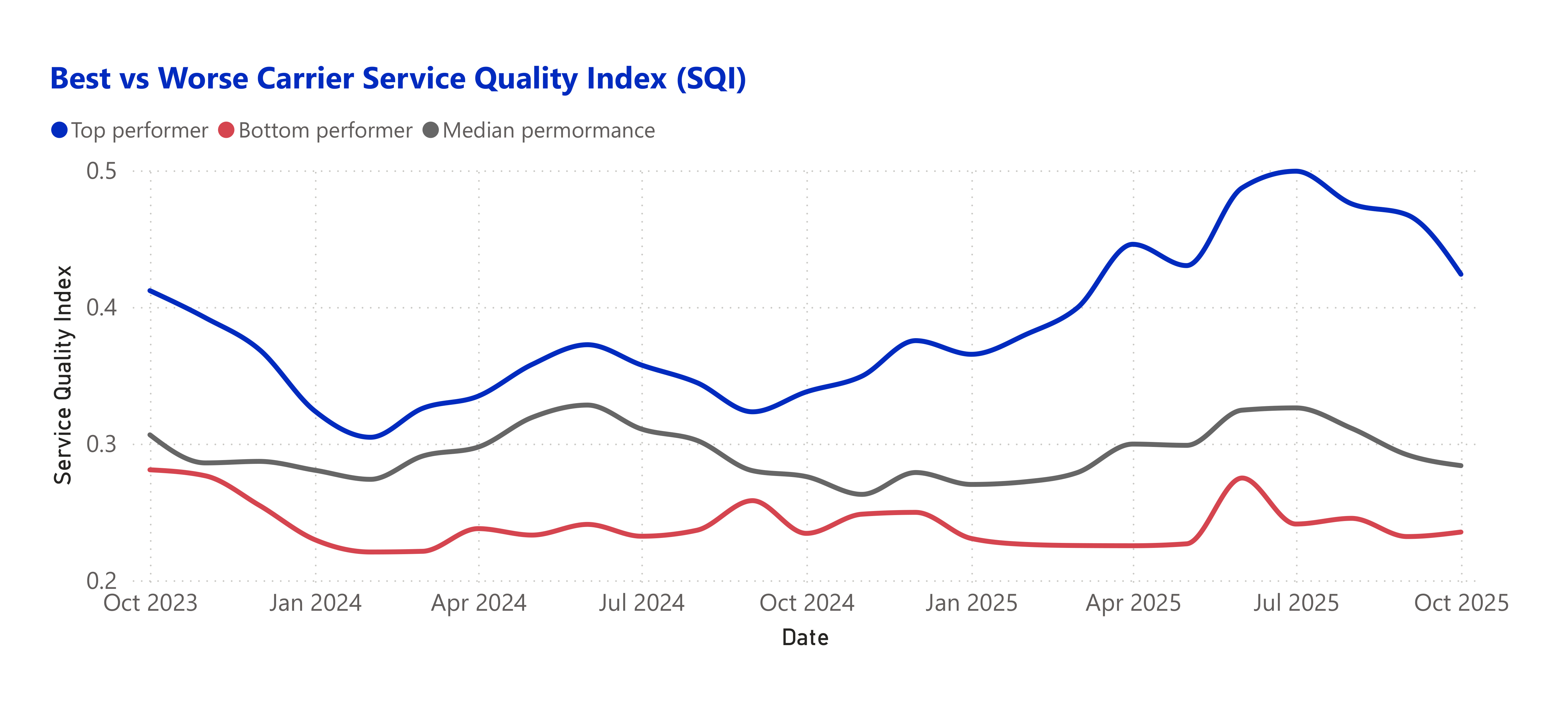

While the overall market tells a story of disconnection between price and performance, a closer look at the carrier-level data reveals a very different reality: service quality is not uniform.

From around March 2025, the spread between the best and worst performers widened sharply.

Our composite SQI shows that while the industry average inched up only modestly, several carriers began to pull away from the pack, evidence that operational investment and network efficiency are delivering better outcomes.

- Hapag-Lloyd and Maersk recorded the strongest improvements, increasing their overall SQI between December 2024 and June 2025.

- Other major lines, made smaller gains but remained below the market average.

- By contrast, some carriers stagnated near the lower bound of the quality range, showing limited responsiveness to post-pandemic recovery pressures.

This widening performance spread coincides with the period when the Gemini partnership began to bed in, and its two member lines started to distinguish themselves from the market average. We have analyzed this previously here Beyond the sailing schedule: a real-world look at Gemini’s impact on container arrival reliability | WiseTech Academy

While correlation isn’t causation, the data supports the idea that not all carriers are equal, and that those who have invested heavily in service reliability are now beginning to stand apart from the rest of the market.

In short, the market as a whole may not yet price quality, but the data shows that quality differentials exist, are growing, and are measurable.

Is there a case for a premium?

The data shows that while freight rates and service quality have moved in opposite directions, a widening gap in performance between carriers suggests there may now be a rational basis for differentiated pricing.

For shippers, the value of reliability is predictability, the confidence that day-to-day logistics will run as planned.

It means:

- a confirmed booking actually ships as scheduled, rather than being rolled or cancelled,

- the booking request is accepted rather than rejected,

- a response is received quickly enough to secure an alternative carrier if declined, or move to the next process sooner if accepted, and

- the cargo arrives within a consistent and dependable delivery window that aligns with production or retail schedules.

These are practical outcomes that determine whether supply chains run smoothly or not.

They are what shippers ultimately value and they are what higher-performing carriers can demonstrably deliver.

It is reasonable that a carrier consistently providing that level of reliability, backed by data rather than marketing, could command a modest premium.

Not as a reward for doing what should be “basic expectations,” but as recognition of the reduced risk and higher probability that a shipment will move as planned.

Our analysis does not argue that shippers should pay more.

It simply shows that service quality differentials now exist and can be verified, providing the foundation for a transparent, performance-linked pricing model, one based on outcomes rather than perception.

The post-pandemic paradox

The pandemic reshaped expectations of price and performance, exposing a lasting gap between what shippers pay and what they receive.

During the pandemic, freight rates surged to record highs while reliability collapsed to record lows.

Bookings were repeatedly rolled, schedules unraveled, and many shippers paid unprecedented rates just to keep cargo moving, often with no certainty that it would arrive when needed.

The pandemic didn’t break a link between price and performance; it revealed that one never really existed.

Rates rose with market pressure, and shippers saw that higher prices offered no guarantee of reliability.

Rates continue to be driven by capacity cycles, operational pressures, and geopolitics, while service quality, though measurable, remains outside the pricing mechanism.

Carriers have invested heavily in improving their service networks, but the market still lacks a way to translate that reliability into commercial value.

The paradox is that shipping lines have never been better equipped to measure performance, yet the market still behaves as if all services are equal.

Until that changes, reliability will continue to be delivered, but not valued.

Turning insight into action

Understanding these service-quality differences is only valuable if it can be used to make better decisions.

That’s where tools like WiseTech’s market intelligence and analytics products come in, providing users with objective visibility into carrier performance, both historically and in near real time.

By integrating operational and performance data, these platforms allow logistics teams to:

- track how individual carriers perform against their peers on key measures such as reliability, booking acceptance, and responsiveness;

- identify trends or deterioration early, before they impact supply chain outcomes; and

- use data-driven evidence in procurement and contracting to align with carriers that consistently deliver stronger service outcomes.

Rather than relying on perception or anecdote, this approach lets shippers and forwarders quantify reliability and reward performance, creating a more informed basis for negotiation and planning.

It turns service quality from something discussed after disruption into something measured, compared, and acted upon.

Conclusion

Container shipping remains a market shaped by supply and demand, operational pressures, and geopolitics.

These forces drive rate cycles, leaving reliability outside the pricing equation.

Yet our analysis shows that service performance now varies meaningfully between carriers, and those differences are measurable, consistent, and widening.

That creates the foundation for a new kind of conversation, one where reliability is treated not as a marketing promise, but as a quantifiable part of the product itself.

Reconnecting price and performance will take time.

It depends on greater transparency in service data, trust in its accuracy, and commercial structures that recognize outcomes.

But it also points to an opportunity: a market where carriers compete on predictability as well as price, and where shippers make procurement decisions based on evidence of performance, not assumption.

Ultimately, the opportunity lies in making reliability visible, comparable, and valued allowing dependable service to become both a competitive advantage for carriers and a real choice for shippers.

Only then can the industry move beyond the post-pandemic paradox, where everyone pays for disruption, but few can measure what reliable service is truly worth.

Further information:

- Download the CargoWise Market Intelligence & Analytics flyer