This year has proven to be a volatile one for the Transpacific trade lane, particularly for shipments from China to the USA.

Recent insights from analysts, data providers, and carrier updates have highlighted the significant impact of the 90-day tariff suspension on booking volumes, spot prices and blank sailings.

According to the Wisetech Global’s Market Intelligence & Analytics platform, booking volumes from China to the USA dropped by 23% in April, following the announcement of the “Liberation Day tariffs”. This decline is not solely due to tariff factors; seasonality plays a role. April typically sees softer volumes.

In May, spot prices jumped in response to a booking surge driven by the 90-day tariff suspension, stabilising somewhat in June.

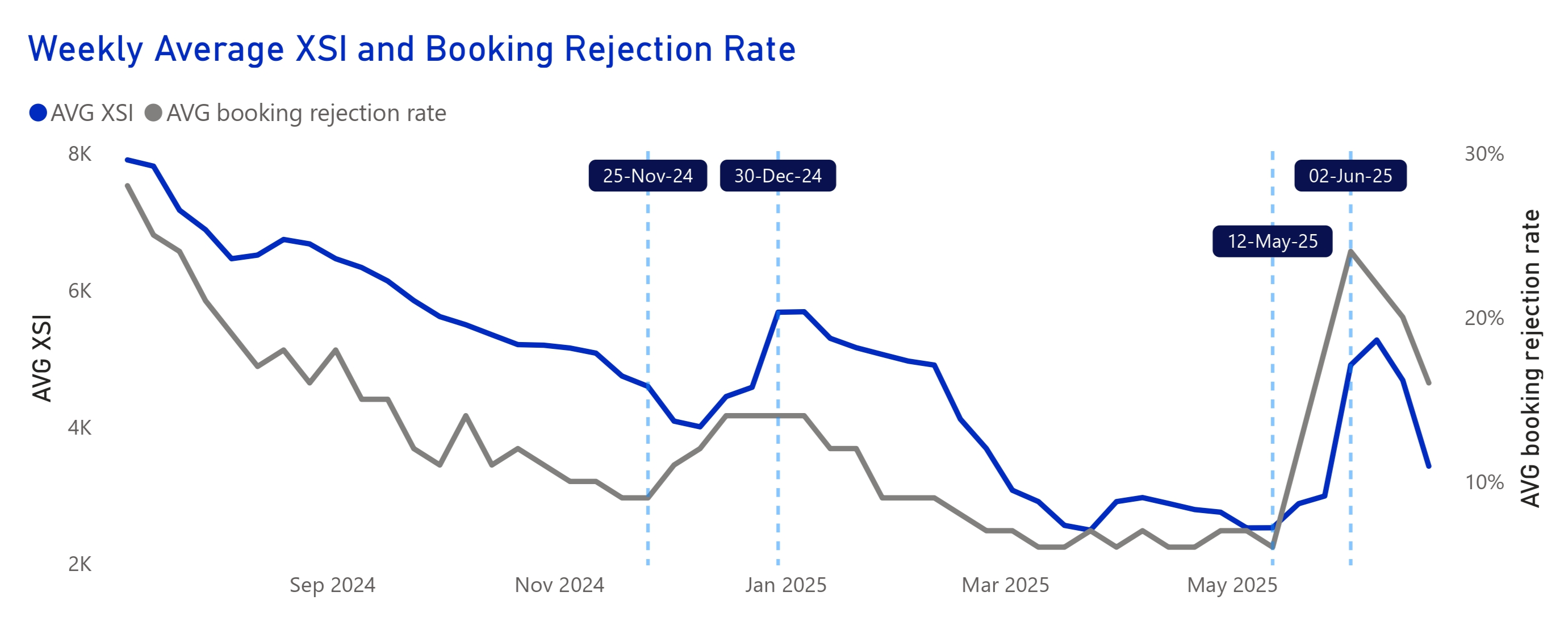

Notably in each case, the booking rejection rate was a strong predictor of spot price increases as carriers responded to uncertainty.

We have seen this before back in December 2024. Then, cargo frontloading to beat threatened tariffs, combined with potential industrial action in ports on the US East Coast, saw a sharp rise in the rate of cargo booking requests being rejected. Shortly thereafter the spot rate, as reported on Xeneta, spiked.

Volatility presents both risks and opportunities for Freight Forwarders and BCOs, with the difference being data.

Wisetech Global’s Market Intelligence & Analytics platform tracks key trends and provides insight into the numbers which shape the market.

Further information:

- Download the CargoWise Market Intelligence & Analytics flyer

- Explore CargoWise mega features

Want to take the next step?

WiseTech Academy is dedicated to democratizing logistics education, making it easier for everyone, regardless of experience, to succeed in the industry. Explore our full range of courses and find the right diploma or certification for you.